|

|||||||||||||

|

|||||||||||||

Real Facts About Real Estate Markets in Thailand

AREA Press Release No. 583/2020: September 30, 2020

Dr.Sopon Pornchokchai, Ph.D. Dip.FIABCI, MRICS

President, Agency for Real Estate Affairs (AREA)

Recently, a real estate information centre of a bank released its findings on real estate markets which was incorrect and misleading. Let’s listen to Dr.Sopon

Dr.Sopon Pornchokchai, President, Agency for Real Estate Affairs (www.area.co.th) which is the foremost and largest real estate information centre in Thailand since 1994 made a comparison on the findings as follows:

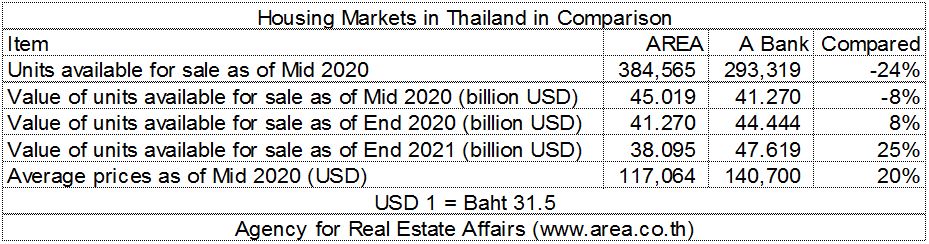

As of Mid 2020, a bank estimated that the number of units available for sale was 293,319 units; whereas, Agency for Real Estate Affairs estimated that it would be 384,565 units. The under-estimation of a bank might under estimate the gigantic housing market problem which needed to be cure in a proper way. It is not only to help them sell the available units but also to curb future development. Otherwise, the problem would become endless.

That bank also forecasted that the value of units available for sale as of mid 2020, end 2020 and end 2021 would be USD 41.270, 44.444 and 47.619 billion respectively. Actually the supplies would be decreased rather than increased because the new supplies would be limited, the existing absorption and some projects might be cancelled over time.

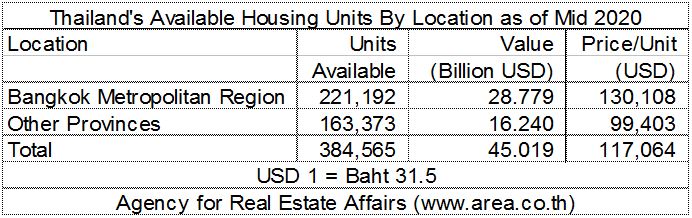

In details, our Agency for Real Estate Affairs reported that out of 384,565 units left for sale, some 221,192 units were in the Bangkok Metropolitan Region (58%) with a total value of USD 28.779 billion or 64% The average price at USD 140,700 delivered by a bank was totally incorrect because it was too high. The average price in Bangkok was only USD 130,108; whereas that in upcountry was USD 99,403. Therefore the overall average price nationwide would be only USD 117,064. Actually, in the US, an average house price was USD 368,700 as of mid 2020 <1> or 3.15 times higher than in Thailand.

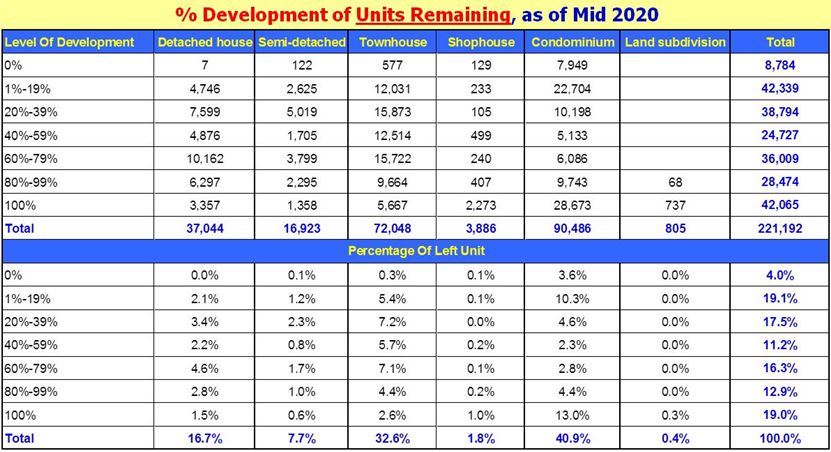

In further details, of the 221,192 units available for sale in the Bangkok Metropolitan Region, 40.9% of them were strata-title condominium or owner-occupied apartments. Townhouses (rowhouses) constituted some 32.6% and detached house (single houses) constituted other 16.7%. The largest proportion of housing units were priced at Baht 2-3 million or USD 63,492 - USD 95,238. It was estimated that without any new or additional supplies, these supplies would be all sold out within 35.3 months. Condominium would spend only 29 months; whereas, detached would spend 64 months or over 5 years to complete the sale.

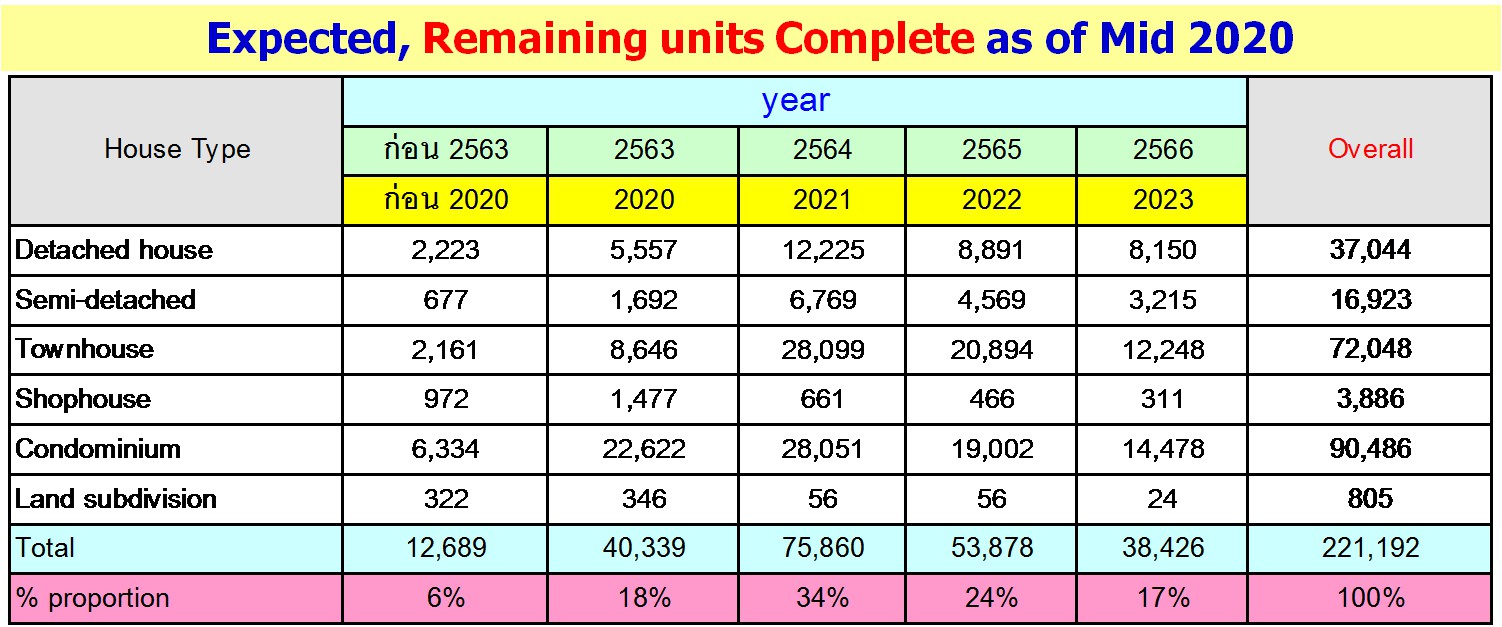

In further details, of the 221,192 units, only 42,065 units (19%) were completed the construction. Those with the completion below 20% were 51,123 units or 23% These supplies would be vanished if the economy was too bad to carry on the development of these units.

In further details, if the completion was forecasted by year, there would be some 38,426 units which would be completed in 2023 which was very long time. Many of these 99,899 units might not be able to be completed if there as an economic crisis after Covid-19.

What would be wrong if we do not have proper information on real estate in Thailand. That an information centre of a bank found only 293,319 units available for sale instead of 384,565 units, implies that we under-estimated the situation. The problem was to gigantic to help stimulate the absorption. The government needs to control the supplies too. Escrow accounts must be enforced to all new development to help protect the customers.

That bank also forecasted that the value of the available supplies would grow from USD 41.270 billion in mid 2020 to USD 44.444 billion in end 2020 and to USD 47.619 billion in 2021. In fact, it would gradually drop from USD 45.019 billion in mid 2020 to USD 41.270 billion in end 2020 and to USD 38.095 billion in end 2021. They did not take into account that the new supplies in 2020 and 2021 would be smaller than those in 2019. Some existing supplies might be cancelled over time; whereas, there was also gradual absorption over time.

Wrong information would provide wrong decision making. To have precise and reliable data on real estate markets, you should rely on the information of the Agency for Real Estate Affaris chaired by Dr.Sopon Pornchokchai.

Reference:

<1> Federal Reserve Bank of St.Louis. Average Sales Price of Houses Sold for the United States. https://fred.stlouisfed.org/series/ASPUS

https://www.facebook.com/dr.sopon4/videos/328421448453969