|

|||||||||||||

|

|||||||||||||

Dr.Sopon Proposing Property Tax on Vacant Housing to Increase Affordable Supplies

AREA Press Release No. 36/2026: January 14, 2026

Dr.Sopon Pornchokchai, Ph.D. Dip.FIABCI, MRICS

President, Agency for Real Estate Affairs (AREA)

Recently, Dr. Sopon Pornchokchai, President, Agency for Real Estate Affairs (www.area.co.th), submitted a letter to Prime Minister Anutin Charnvirakul and the leaders of various political parties regarding a proposal to develop the national economy by taxing vacant real estate.

Given the current slow 2026 economic growth, projected to expand by only 1.5%-1.8 % and continuing to slow down from 2024-2025, Agency for Real Estate Affairs, the first real estate information center in Thailand with the most continuous database since 1994, proposes a national economic development strategy by imposing a tax on vacant real estate.

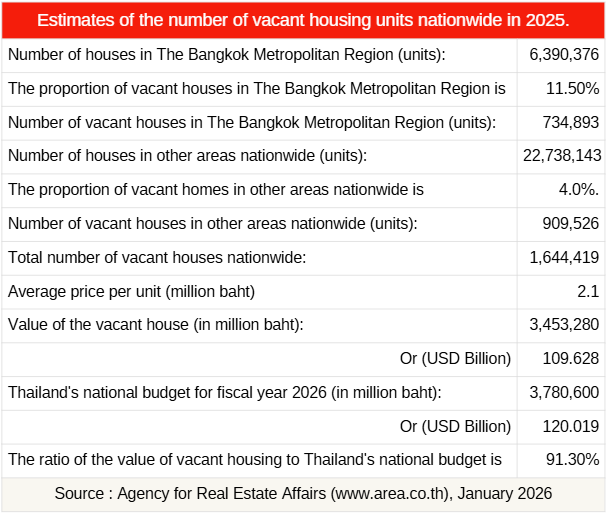

Agency for Real Estate Affairs has surveyed vacant housing, or completed but unoccupied residential units (including low-rise residences and condominiums), since 1995. In 1998, approximately 350,000 vacant units were found and the number of vacant housing has continued to increase. Most recently, out of 6,390,376 housing units in The Bangkok Metropolitan Region, an estimated 734,893 units are vacant.

For other areas nationwide, totaling 22,738,143 units, the estimated vacant rate is 4.0%, therefore the total number of vacant homes in other areas should be 909,526 units. The total nationwide vacant homes would be 1,644,419 units. Assuming an average price per unit of 2.1 million baht, the value of vacant homes amounts to 3,453.28 billion baht (USD Billion 109.628), which is almost equal to (or 91.3%) the 2026 national budget (3,780.6 billion baht or USD Billion 120.019).

These vacant houses are not utilized; their owners may simply hope to keep them as asset to pass on to future generations or as an investment or speculation. These houses are ideal for residential uses because they are often located in city centers with complete infrastructure. This leads to endless expansion of housing development outwards, destroying rural areas and green spaces, and necessitating continuous expansion of infrastructure. Dr.Sopon therefore proposes taxing these vacant houses, with the following details:

1. Of the 1,644,419 vacant homes, assuming 90% have been vacant for more than one year. That would be 1,479,977 units. (Homes vacant for less than a year may still be in the process of preparing to move in).

2. Assuming the government-assessed value is approximately 40% of the average market price of 2.1 million baht, or equivalent to an assessed value of 0.84 million baht per unit (USD 26,667)

3. The taxable value of the vacant houses therefore totals 1,243.181 billion baht (USD 39,466 billion)

4. If a 2% tax is collected annually, 24.864 billion baht (USD 789.3 million) would be generated each year for national development.

Implementing a tax on vacant homes would encourage homeowners to sell or rent, increasing the housing supply and lowering housing prices and rental rates. This would make it more affordable for those wanting to buy or rent, allowing them to reinvest their savings. It's estimated that in the first year, approximately 5% of vacant homes could be sold. Assuming a price of 2.1 million baht, this would generate 172.664 billion baht (1,644,419 units x 5% x 2.1 million baht or USD 5.481 billion). This circulation of money would further stimulate the economy.

This also includes old, unused buildings, whether business or industrial, as well as vacant land. It could be mandated that all unused vacant land be taxed, regardless of whether it's (pretending to be) used for agriculture (especially in urban areas) or not. This would incentivize the full utilization of real estate instead of horizontal urban expansion in suburban or agricultural areas (because landowners in urban areas are unwilling to sell but hope to keep their land with little paying tax). If such serious taxation of other types of real estate is implemented, it could generate hundreds of billions of baht annually, leading to economic growth.

For landowners who are missing or cannot be in contact within, for example, a specified period of three years, the government can sell these assets on an open market price. The government will collect a 10% tax, and the remaining funds can be held in a state financial institution, where the owner can withdraw later, along with interest.

Furthermore, in the future, the government should allow local authorities to conduct their own property valuations in accordance with market prices. This would enable local authorities to generate revenue for efficient local development without relying on the central government. Based on the experience of cities around the world, having a local property valuation agency is inexpensive and highly cost-effective for tax collection.

Taxing the rich to help the poor and the country at large.